Customer Profile

I. Overview

This customer profile focuses on individuals and businesses using [Your Company Name]'s financial services and banking products. It highlights the specific needs and behaviors of the customer base to guide service improvements and personalized offerings.

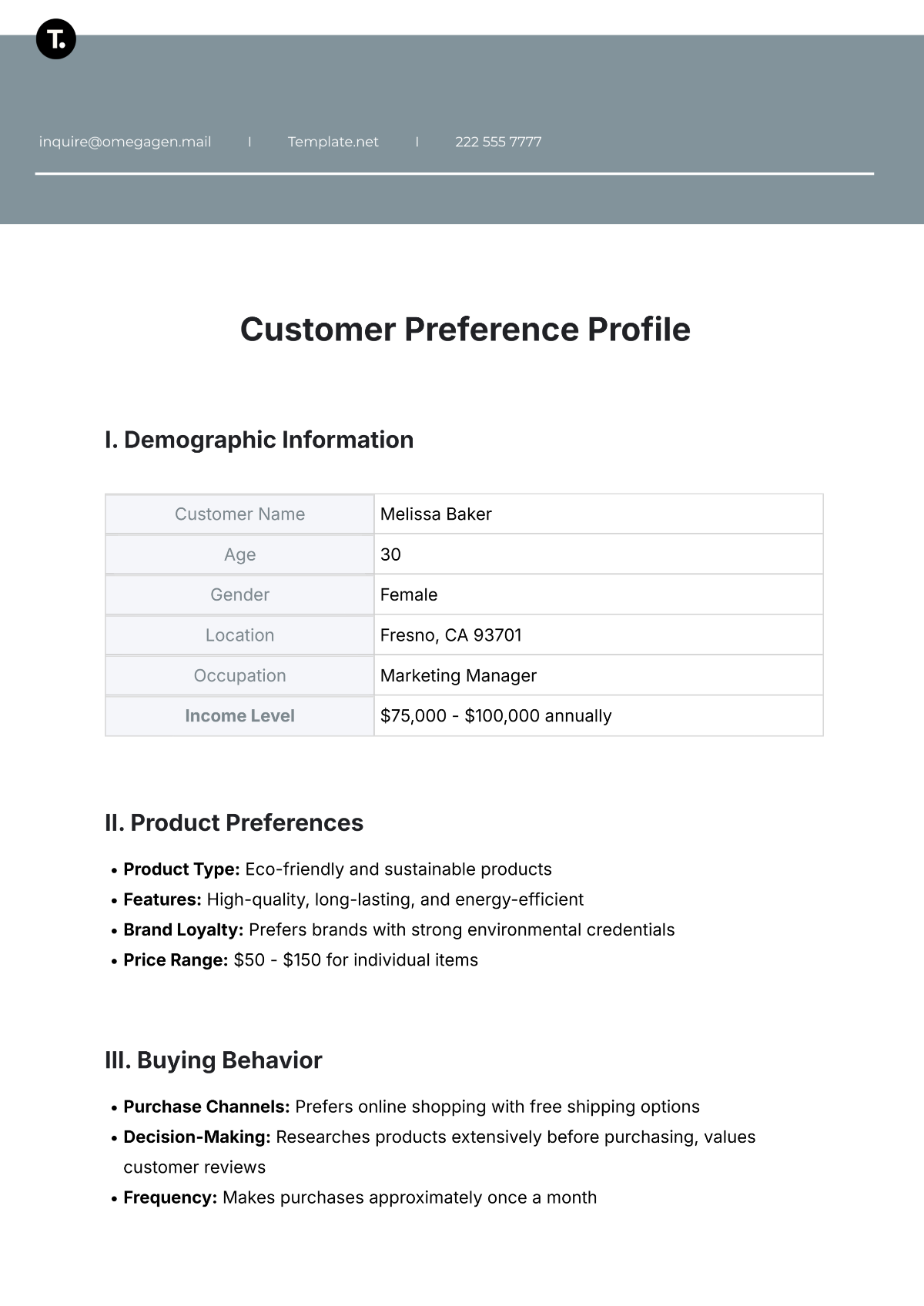

II. Demographics

Age Group: 30–55 years

Income Level: Middle to high income

Occupation: Professionals, small business owners, executives

Location: Primarily urban areas, with a focus on regional financial centers

III. Financial Behavior

Banking Needs: Personal loans, business loans, savings accounts, investment portfolios, and insurance solutions

Service Preference: Digital-first approach with strong interest in mobile apps and online platforms; desire for personalized financial solutions

Risk Appetite: Generally moderate, favoring stable investment options with some interest in higher-risk opportunities like stocks and mutual funds

IV. Preferences

Technology Usage: High usage of [Your Company Name]'s mobile banking app, expecting seamless, secure, and real-time access to financial data

Service Expectations: Prompt customer service, secure banking environment, tailored advisory services

Product Demand: Demand for comprehensive financial packages combining loans, investments, and insurance in a single platform

V. Key Challenges

Security Concerns: High concern for data privacy and fraud prevention

Financial Planning: Balancing short-term liquidity with long-term wealth accumulation

VI. Marketing Strategy

Communication Channels: Focus on digital communication (emails, app notifications), social media, and targeted campaigns based on individual financial profiles

Value Proposition: Highlight security, convenience, and personalized financial planning with [Your Company Name]'s comprehensive service suite.